What is Act 22?

Act 22 was approved in 2022, entitled "Act to Promote the Relocation of Individual Investors to Puerto Rico”. Currently, this law is sheltered under Act 60.

¿A quiénes beneficia?

With the promise of attracting foreign capital and foreign investors to the archipelago, Act 22 allows those who qualify and obtain a decree as individual investors to request a variety of benefits for which residents of Puerto Rico do not qualify.

These benefits include 100% of exemption from income taxes on all income, dividends and interest and 100% exemption from income and capital gains taxes.

In other words, $0 in taxes in exchange for spending half of the year in Puerto Rico.

Act 22 Requirements

- Not being a resident of Puerto Rico between 2006 and 2012 and not having a taxable home outside of Puerto Rico.

- Reside at least 183 of 365 days a year in Puerto Rico.

- Donate $10,000 to Puerto Rican non-governmental organizations

- Buy a house in Puerto Rico during the two-year period after obtaining the decree

Why eliminate the provisions of Act 22?

1. Lack of Transparency

Despite this data being public information, it is not yet available to the general public or the press, even after specific requests and litigation in this regard. .

The Department of Economic Development (DDEC) "cannot" oversee the program adequately.

The agency in charge of granting and supervising the decrees has indicated that it does not have the necessary tools to supervise compliance with the decrees granted under Law 22. There was no supervision during the first eight years after the approval of the law, creating an information vacuum about the appropriate use, benefits or deficiencies of the program.

Who does the DDEC protect?

With its lack of transparency and desire to hide information about individual investors, the DDEC protects and benefits people who receive personal income or income from their companies fraudulently or illegally. From the beginning of Law 22 to the present day, individual investors have been accused of corporate and government fraud, money laundering, fraud, embezzlement, and investment fraud, among other crimes.

Despite the fact that the DDEC announced a general audit of compliance with Law 22 in March 2021, the results are still unknown as of this date.

2. IRS and Tax Evasion

In 2023, the IRS announced an investigation of 100 wealthy Americans who may be using island’s tax breaks to cheat on taxes.

Individual investors “play” with the system in Puerto Rico

Individual investors who use the subterfuge of not declaring their income as coming from the United States benefit from the essential services provided by the states and Puerto Rico without paying taxes in any jurisdiction.

Even in compliance with IRC Section 937, the IRS believes that individual investors may be misreporting US source income as Puerto Rico source income to avoid paying taxes in the United States.

The United States Congress in search of explanations

The campaign carried out by the IRS originated when el Congress asked the IRS for a report on Puerto Rico's tax incentives due to concerns about the possibility of tax evasion practices.

Near the end of 2023, a dozen congresspeople sent a letter to the IRS asking for explanations regarding their lack of supervision of Law 22

In 2024, and anonymous agent inside the IRS denounced that the audit process of Law 22 had not been carried out properly. In response to these complaints, the agency announced that they would be assigning more agents to the investigation.

3. Economic Impact

Despite having very little information and transparency about who benefits and what are the profits of individual investors, the few data available reveal that the People of Puerto Rico lose billions of dollars due to Law 22.

The Department of the Treasury that cannot do anything

The data available on the economic impact of the decrees granted is very scarce and one of the reasons is that the Treasury Department has neither sufficient authority nor resources to oversee and revoke decrees.

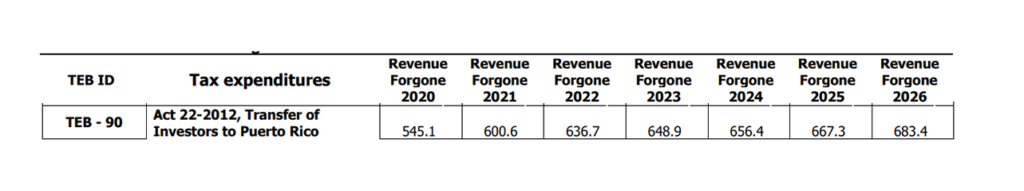

As published by the Treasury in March 2023 in its Tax Expenditure Report for Taxable Years 2020 to 2026the Government of Puerto Rico stopped generating around $4,400 million as a result of Act 22. More than four billion dollars lost in the midst of a crisis where the country does not know if it can keep its essential services operating.

The Department of Economic Development (DDEC) has gone years without auditing beneficiaries

From 2015 to 2021, the DDEC had not verified any annual report filed by individual investors individual investors, failing to comply with its obligation under the statute to audit the 3,311 people covered by Law 22.

The Secretary of the Treasury has established that the lack of transparency within the DDEC about who has decrees in force under Law 22 means that the Treasury only has an estimated number of forms that it must receive from the beneficiaries of Law 22. There is no way to have a real measurement of the economic impact of a group without knowing who and how many they are.

4. Displacement

The purchase of properties and land by individual investors has disproportionately increased property values in the areas and towns where their investment has been concentrated. individuos inversionistas ha incrementado considerablemente el precio de bienes raíces en áreas y pueblos donde se ha concentrado su inversión. Most Puerto Ricans are unable to pay the inflated purchase prices and inflated rents of today's market.

This has led to the displacement of Puerto Ricans from their communities where they have their personal, family, cultural and historical ties. These communities are forever disrupted and their continuity and history are endangered.

Nearly 50% of the families that rent in Puerto Rico invest more than a third of their income towards paying rent. This increases their home insecurity, particularly when faced with risks such as natural disasters and unemployment.

In its customary lack of transparency, the government of Puerto Rico does not provide official data on the tendency of individual investors to buy properties that make up entire neighborhoods and communities. These investors are buying up entire sectors, forcing communities to move to then convert the properties into AirBnB or for resale at much higher prices.

The displacement and gentrification that began in the municipality of Dorado and sectors of the metropolitan area, has now become a threat in many areas, particularly coastal towns, around the entire island. Some examples are:

The Municipality of Quebradillas

A former Republican senator from Rhode Island, Giovanni Feroce, displaced renters who were already paying about $600 a month, already exceeding the average monthly rent in that municipality.

In anexample of the dubious reputation of various individual investors, Feroce is listed as #3 on the list of the 100 biggest tax offenders in the state of Rhode Island, with a debt of $1.2 million.

Municipality of Cabo Rojo

A group of residents of a community in that municipality were forced to sell their properties after they were denied the necessary construction permits to fix their homes after Hurricane María.

After they sold their properties, the new owners were granted the necessary permits to redevelop the properties for the purpose of selling them at a higher value or using them as short-term rentals.

Residents of Puerta de Tierra, San Juan

Residents of Puerta de Tierra, where entire blocks of the historic community have been displaced, as well as residents of the communities of Santurce in San Juan.

The municipalities of Vieques, Quebradillas, Aguadilla, Luquillo and Rincón requested the Legislative Assembly to repeal Act 22 due to its local impacts..

5. Environmental Impact

The property and land purchases by individual investors has had a direct impact on the environment, especially land near the coasts and those near natural landscapes, which are preferred by investors.

Illegal Development of Natural Resources

This new trend in the real estate market has disproportionately increased the value of coastal land, beaches, and mangroves that protect the coasts of Puerto Rico and other natural resources.

The new market value of these properties and lands and the ability to generate profits have led to their development without considering the environmental impact and often illegally.

Several investment and development projects that directly affect the environment have recently been denounced.

Denounced Proyects

- The Deforestation of mangroves and filling of wetlands in a nature reserve in Salinas for private use..

- The expansion of a luxury housing complex, Bahia Beach, in Río Grande, which threatens the Espiritu Santo Nature Reserve.

- The Luxury housing development for sale directly above the Las Golondrinas cave in Aguadilla.

En la coalición Puerto Rico No Se Vende estamos comprometides por Puerto Rico.